What do you need to transfer ownership of a vehicle in Spain?

The second-hand car market has always been a good option when buying a car. Normally, in order to transfer a car between private individuals, you go to an agency that will take care of all the paperwork in exchange for an economic outlay. However, these procedures are not too complicated and if we do them ourselves, we will save a lot of money.

To complete the transfer of a car or any other motor vehicle, there are two institutions to complete: The Inland Revenue and the Dirección General de Tráfico. With the advantage that in some communities at least the procedure with the former can be done telematically if you have a digital certificate, so you only have to travel once to change the name of a car.

Step 1 – Gather the documentation

Let’s take a look at all the necessary steps to be able to transfer a car or any other motor vehicle ourselves. Firstly, to change the name of a car we need to make sure we have all the necessary documents. Both for the car, the buyer and the seller:

1, Contract of sale and purchase duly signed by both persons. Original and copy.

2. Photocopies of the ID cards of the seller and the buyer of the vehicle.

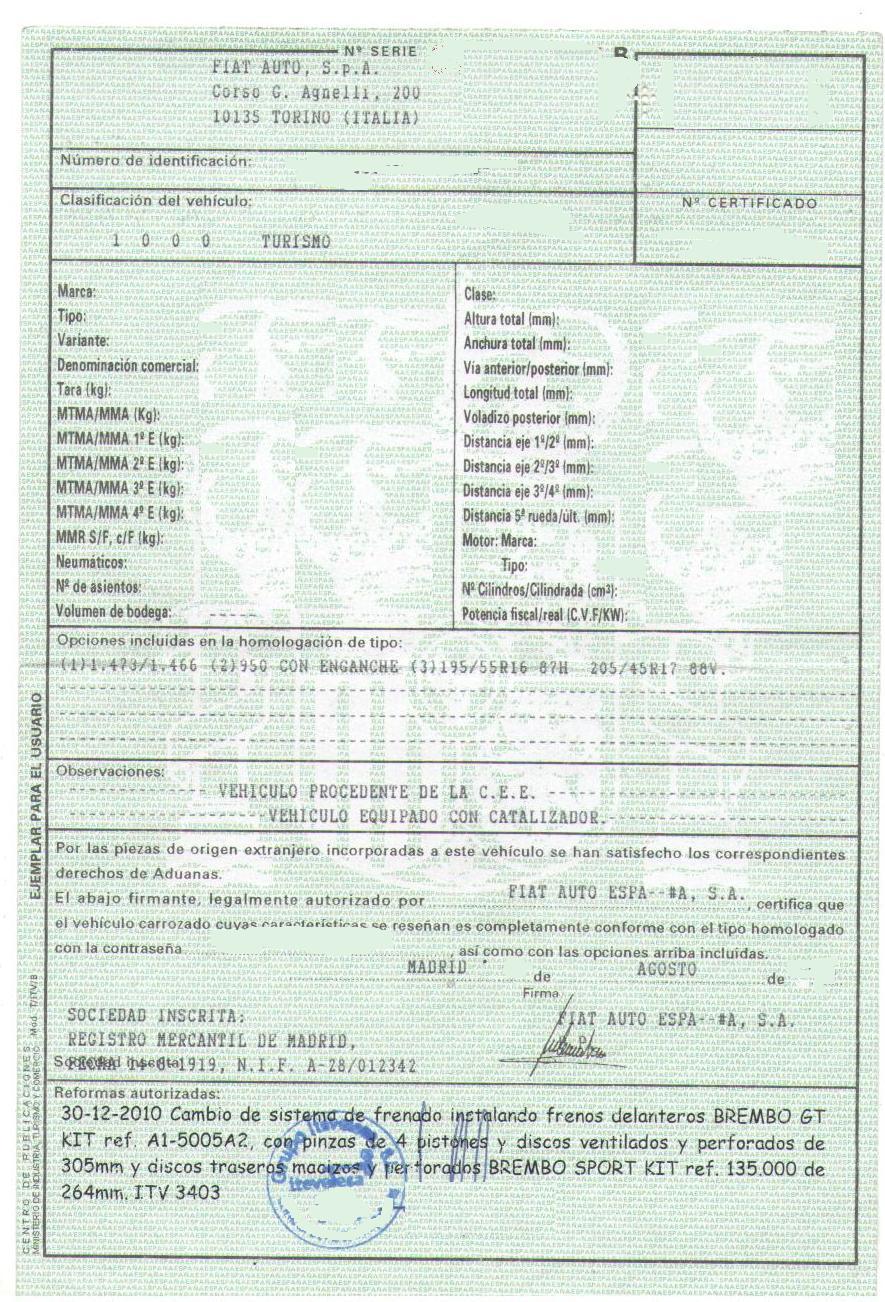

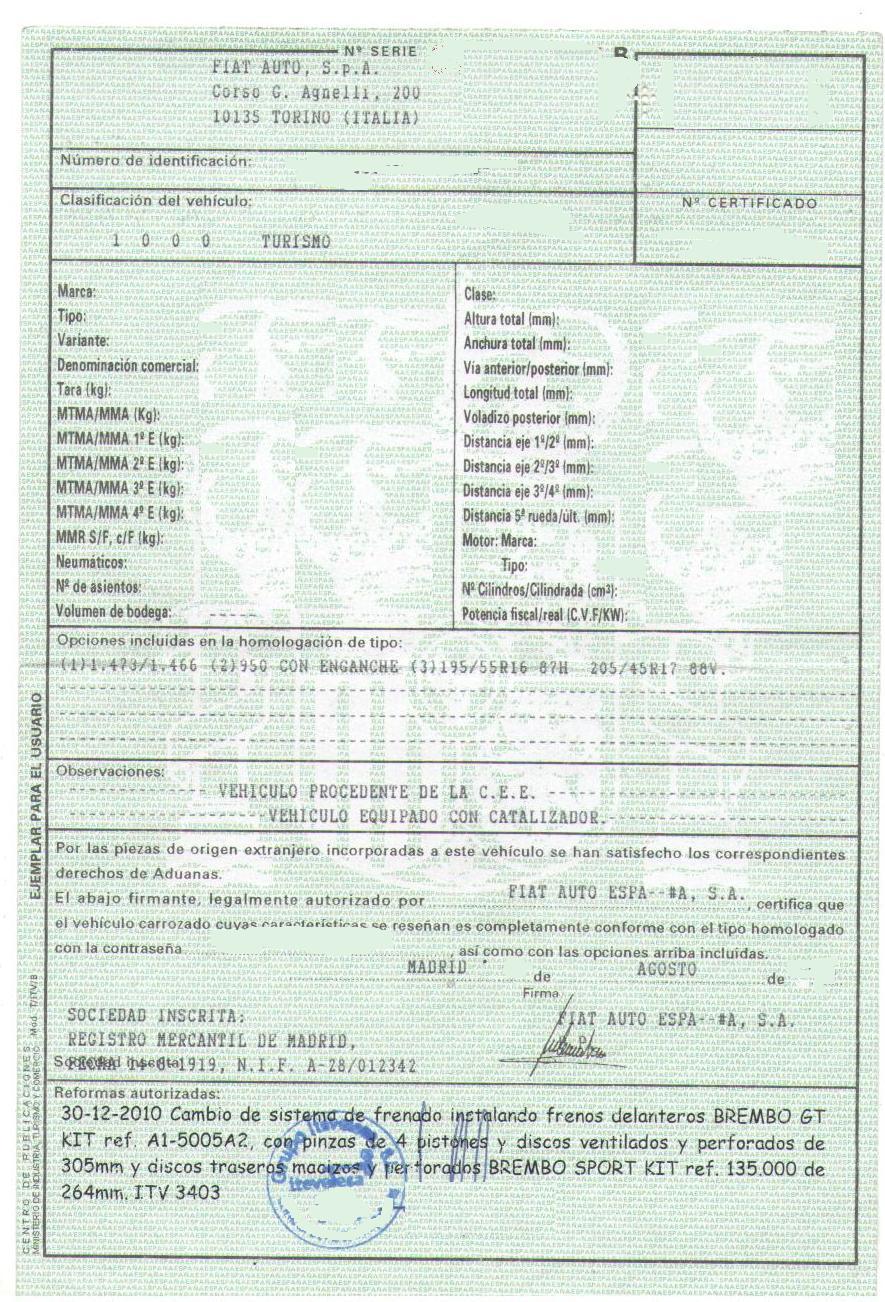

3. Compulsory documentation of the car. This consists of the car’s ITV card (MOT Certificate) with the ITV in order and the vehicle’s registration certificate.

4. Last of all, receipt of the paid road tax.

Application for the transfer of the vehicle. In which the details of the vehicle, the buyer and the seller must be included.

VEHICLE REGISTRATION CERTIFICATE

DO YOU NEED HELP WITH VEHICLE TRANSFERS?

With over 20 years experience in vehicle transfer and registration. Contact us today for a FREE consultation

Step 2 – Procedure with the Inland Revenue

The next thing to do is to pay the Transfer Tax (Impuesto de Transmisiones Patrimoniales). The amount of this tax depends on the value and age of the vehicle you are selling. This is done by means of Form 620 or 621. Depending on the region, this can be done online if you have a digital certificate. For example, in Madrid, in the following tables you will find all the necessary data to calculate this tax:

Look up the value of the car in the BOE. In this case they are the average prices stipulated for 2018 for all models sold in Spain.

Apply the loss of value according to the age of the car to buy. These are all the percentages according to the age of the car:

- Up to 1 year: 100%.

- Between 1 and 2 years: 84%.

- Between 2 and 3 years: 67%.

- Between 3 and 4 years: 56%.

- Between 4 and 5 years: 47%.

- Between 5 and 6 years: 39% Between 5 and 6 years: 39% Between 6 and 7 years: 34% Between 6 and 7 years: 34

- Between 6 and 7 years: 34% Between 7 and 8 years: 28% Between 7 and 8 years: 28

- Between 7 and 8 years old: 28% Between 7 and 8 years old: 28% Between 8 and 9 years old: 24

- Between 8 and 9 years old: 24% Between 9 and 10 years old: 19% Between 9 and 10 years old: 19% Between 8 and 9 years old: 24

- Between 9 and 10 years: 19% Between 10 and 11 years: 17% Between 10 and 11 years: 17

- Between 10 and 11 years old: 17% Between 11 and 12 years old: 13% Between 11 and 12 years old: 13

- Between 11 and 12 years old: 13%.

- More than 12 years: 10%.

Example of the calculation: if the car has a value of 13,000 euros according to the BOE and is 9 years and 2 months old, its value today would be: (13.000 x 19)/100= 2.470 euros.

To this result you will have to apply the percentage of the Transfer Tax of your Autonomous Community:

Andalusia, Aragon, Asturias, Balearic Islands, Ceuta, La Rioja, Madrid, Melilla, Murcia, Navarre and the Basque Country: 4%.

Castile and Leon and Catalonia: 5%.

Canary Islands: 5.5%.

Castile-La Mancha, Valencia and Extremadura: 6%.

Cantabria and Galicia: 8%.

Example of the calculation: If the car we have calculated above is going to be for an owner registered in Madrid, 4% corresponds to him. Therefore, the Transfer Tax would amount to: (2.470 x 4)/100= 98,80 euros.

Step 3 – Procedure with the DGT

The next step to change the name of a car is to go to a DGT (Dirección General de Tráfico) office. At the DGT we must hand in all the documentation we have, both the documents we talked about at the beginning and the proof of having paid the Transfer Tax (Impuesto de Transmisiones Patrimoniales). There we will have to fill in the Application Form for Change of Ownership and Notification of Sale of Vehicles. In addition to paying a fee of 54.60 euros (updated data for 2018).

At this point, it can be said that the transfer has been successfully completed. In addition, we already have all the documentation duly updated with the name of the new owner.

Important: To avoid confusion later on, the buyer should send a copy of the new registration certificate with his name on it to the seller. The copy must be sent to the seller within 15 days. If you do not receive it, go to a Jefatura de Tráfico to notify that you have sold the vehicle. This is the same Application Form that we linked to above in this section.

As you can see, it is a simple process, with which you can save the money of the agency. This process is only valid for the sale and purchase of cars between private individuals. Later on, we will see what to do if you buy a car from a company.

What documents should the seller keep?

- Original contract of sale

- Photocopy of the buyer’s DNI or Residence Card.

- New Driving Licence showing the buyer as the new owner of the car.

- Which documents should the buyer keep?

- Photocopy of the contract of sale

- Photocopy of the seller’s National ID card or Residence Card

- Application for change of ownership of the vehicle signed by the buyer and seller.

- The vehicle’s documentation: Driving licence, MOT card and receipt of the municipal road tax for the previous year.

CONCLUSION

Although the process may seem quite complex, it is in reality quite simple. It is however very time consuming as you will need to book appointments and often means going to different places which can be some distance from each other. Please don’t forget to include all the documentation which must be correctly completed as the Spanish authorities are sticklers when it comes to forms.

For hassle free vehicle transfers, contact us today